In March 2020, the Reserve Bank of India announced a relief measure for borrowers by allowing an EMI moratorium on all kinds of term loans and credit card repayments. It was introduced for three months (March-May). Later, it was extended till August 31, 2020. As per this moratorium scheme, lending institutions were instructed to postpone and defer the EMIs for customers opting for the moratorium scheme.

But you might be wondering, what is a loan moratorium?

Let’s take a detailed look.

The Oxford dictionary has defined moratorium as ‘a temporary stopping of activity, especially by official agreement.’ To further elaborate, a moratorium temporarily suspends activities until any future events inform the removal of this suspension; or until the issues have been solved. In a financial crisis, moratoriums are beneficial as temporary solutions.

How does it work?

Moratoriums are of great help when a crisis breaks the normal routine. If a country is suffering the aftermath of any natural disaster such as earthquakes, floods, droughts, or disease outbreaks (such as COVID 19), emergency loan moratoriums can be granted by the central government or the central bank. It can be lifted once the crisis is averted.

Hence, if the RBI declares a moratorium on loans, banks cannot declare borrowers as loan defaulters if they are unable to pay their EMIs. However, this will be mentioned in the borrower’s credit records. Banks cannot judge you or treat you negatively for availing of the loan moratorium.

When the country was battling with the outbreak of Covid-19, the government of India imposed a nationwide lockdown on 23rd March in order to contain the spread of the disease. This led to job losses for millions. Considering the financial emergency, the RBI declared a three-month moratorium for all payments due between March 1, 2020, and May 31, 2020.

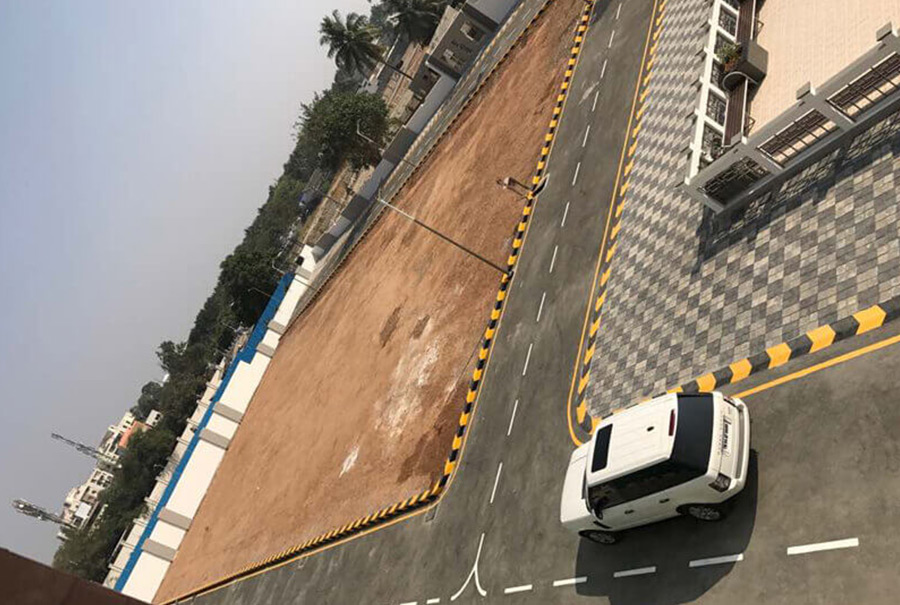

So if you purchased plots near Mannivakkam by taking a loan from any bank, and because of the pandemic and job losses, you were unable to pay the monthly installments, the loan moratorium would help you.

Moratorium period

The loan term during which any borrower of loans is not forced to pay any EMIs or other repayments by the banks or other lending institutions is known as the moratorium period. It can also be regarded as a waiting period before resuming the repayment of EMIs.

Moratorium 2.0

Those borrowers who did not opt for the loan moratorium in 2020 can avail of its benefits under the 2.0 version. Moreover, borrowers who already availed of it for the first time in 2020 are also eligible for the second one for up to a period of two years. However, to be eligible for the second moratorium, accounts of borrowers should not show any default on any loan repayments till 21st March 2021. In case of any failed repayments not cleared within 90 days, a loan account is declared as defaulting.

Application for loan moratorium 2.0

The RBI declared the last date of application for the second loan moratorium for eligible borrowers to be 30th September 2021. It can take up to 90 days for your bank to offer the facility if you are already an eligible candidate.

Measures to recover home loan dues

If you have bought plots near Mannivakkam or availed of home loans, no fresh measures have been announced to cope with the economic impact of the pandemic. Various credit bureaus reports show a sharp spike in the number of defaulters who belong to the premium segment and have borrowed more than Rs. 75 lakh and more.

In order to recover from such delinquencies, banks are being forced to take up aggressive methods of loan recovery. As there is no new announcement of loan moratorium from the RBI, banks, and lenders have resorted to repossessing properties and land by auctioning them. Such measures are necessary to recover the dues from various defaulters of home loans. Some of the prominent lenders who have repossessed properties are HFCs such as IIFL Home Finance, Tata Capital Housing Finance, Muthoot Housing Finance, and Manappuram Home Finance. Some banks have also followed this path- Union Bank of India, IDBI Bank, and Bandhan Bank.

Hence, if you are eyeing a poster showing Mannivakkam land for sale or low budget plot in Mannivakkam by availing of home loans from a bank or a financing company, be wary.

Banks have been severely affected due to delinquencies of home loan borrowers. More so for those borrowers who were self-employed and lost their earnings owing to the first and second wave of the pandemic. Since the RBI is not likely to provide any kind of boost to the market, credit bureaus and banks will continue their aggressive recovery methods to make up for their loss.

Hence, if you want to buy plots near Mannivakkam, make sure you have your repayment plan chalked out. For borrowers who have liquidity, it is best that you do not default on your loan account.

Leave A Comment