You might have heard of the idiom- don’t bite more than you can chew. Wondering how that is relevant to your home budgets? Think of it this way- your purchase should never be more than what you can afford.

Now affordability is a relatively subjective term. However, you need to understand your affordability as a buyer before you buy a luxury apartment in Chennai. No matter where you fall on the spectrum of affordability, it is important for you to chalk out the loan amount as well as your other expenses. If you are a first-time buyer, you might be prone to making the mistake of ignoring the other expenses apart from the cost of the house.

Are you confused? Don’t worry, we’ve got your back. Let’s take a look at some of the factors you need to add to your checklist as home budgeting.

Down payment

Do not get excited when you get low amounts of EMIs. You should be able to pay the down payment which is 20% of the total mortgage or loan amount. If you are unable to pay this amount, you will not be eligible to apply for any home loans! In fact, the RBI has mandated that all banks and lending institutions are eligible for granting 80% of any property value in the form of a loan.

Remember, the more you pay as down payment and closing costs, the lesser is the life of your loan.

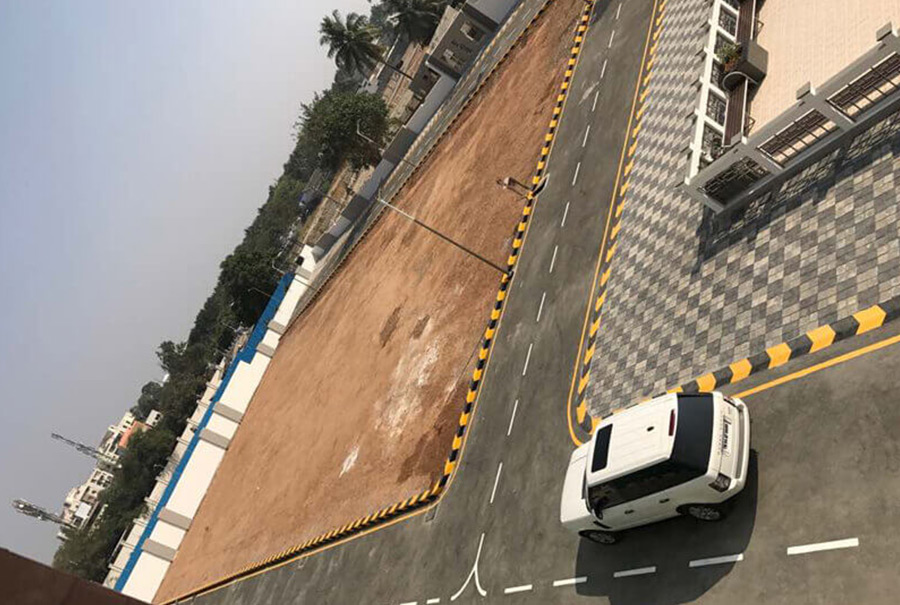

If you are falling short on your down payment amount, you can try and opt for a low budget plot in Mannivakkam as it is a better option for you- which leads to our next point of discussion.

CIBIL score

If you have just started out on your career, the chances of having a good CIBIL score are low. So you need to take some time and work towards getting a decent CIBIL score.

CIBIL score is calculated in your availing of a loan, and/or credit card and your repayment habits. If you clear your EMIs on time and opt for a healthy mix of secured and unsecured loans, and don’t have too many inquiries for a loan, you are good to go.

Focus on timely clearance of EMIs, no matter how big or small the amount is.

Expenses apart from the mortgage

We understand that getting your bank’s approval is a crucial step in the process of buying a home for yourself. But that is not everything! You need to anticipate multiple recurring expenses as homeowners. A luxury apartment in Chennai will not only cost you its price tag, but also homeowner’s insurance, maintenance costs, repair costs, and other utilities. Property tax is another important expense that many buyers tend to overlook.

All these above-mentioned expenses add up when you are considering your monthly spending along with your EMIs. But it is important to calculate these expenses as it will give you a glimpse of your true affordability. You might realise that your obligations have doubled overnight.

Go for a property you can handle easily

Another factor that goes into determining your affordability is the size of the property. Before you go berserk on finding a house for sale in Mannivakkam, consider its size and condition. A big house does not necessarily mean a smart purchase option. If you take into consideration the cooling costs, it may break your budget! Think about the summer months how much money you need to pay to cool your house. So that price tag you see now on that nice house in a good neighbourhood might seem to be completely out of your budget when you realise the amount to be spent on monthly bills and much-needed renovations.

Wait for the best home loan rates

The months between October and December are the best to buy property. Whether you are looking for luxury apartments in Chennai or a budget plot in Mannivakkam, look out for the festive months as banks and lending institutions offer discounts and lower interest rates on home loans. If you are buying your house through a real estate agent, expect good deals around this time of the year.

Although the rate of interest on bank loans may dip only by 2%, remember that you are borrowing in lakhs from the bank! A small dip in interest will matter a lot. You can also look for fixed or floating rates in order to avoid paying more than what you wanted.

Be patient when looking for a house

Once you figure out the payment plan and your budget, be patient with your purchase. Buying a house might be the single largest purchase in your life, don’t rush it.

You wouldn’t want to wait for too long either- to avoid this crisis is to make a checklist of all the factors you would want in your house along with the non-negotiable ones. Look for options and be flexible when it comes to the size. You would want to go up or down a few square feet; or consider resold property. Choose a place that makes you feel at home. Picture yourself living there for the next four-five years at least.

Consider home inspection

A home inspection will reveal faults and problems in the property. In this way, you will have a checklist of things to be done before you move in.

Budgeting before buying a house is crucial and should not be skipped. If you simply look at the price tag and close a deal, you can easily find yourself in a tight spot. To avoid any stress make a checklist with the important factors as stated above and prepare yourself for the big purchase of your dreams!

Leave A Comment