Have you recently bought land in Mannivakkam or closed an apartment deal? You have finally got a green signal from your bank as they approved your home loan. It is a dream come true! You cannot wait to move into your new apartment or start planning on hiring a professional to finally build your dream house. You now have a place that is completely yours. The days of putting up with an annoying landlord are finally over.

But wait, there is another crucial step involved to complete the process of buying property- mutation. Don’t worry, it is not a very complicated process. But it is important for you to get it done.

So what is mutation?

The Economic Times defines mutation as the process of transferring or changing the name of the owner of a property in the records of the local governing body where the property is local.

Let’s delve a little deeper into the concept of mutation.

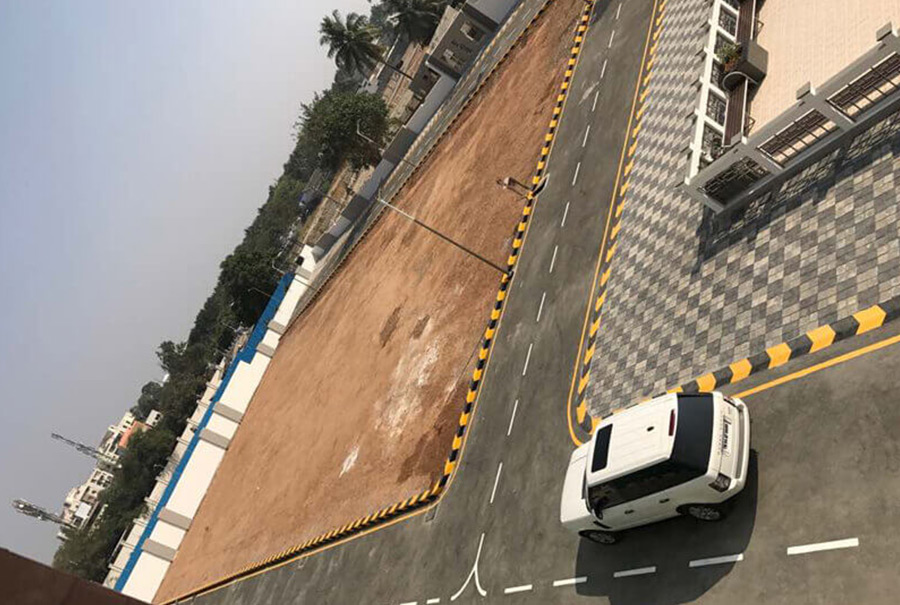

Suppose there are plots for sale in Mannivakkam, Ramnagar and you are an interested buyer. In that case, the mutation of property is important.

Property mutation is the act of transferring or changing the title of the property registered under the title records of the local governing body. This change of name can take place for a couple of reasons- with the passing of the property’s original owner or a hand-me-down due to inheritance of property.

Once the mutation is completed, the new owner is legally able to register the property under his/her name. The government and land revenue department will also be able to levy the charges and taxes under the name of the new owner. It is an essential step that is necessary to perform for the upkeep of government records.

Why do I need to complete the mutation of property?

It is important to undergo the process of mutation of your property because the municipal or corporation body needs to keep a tract of the transfer of ownership. Otherwise, the property tax will be enforced on previous owners. It is the responsibility of a taxpayer to do the mutation.

There are some benefits of property mutation as well. If you have bought land in Mannivakkam, once you are done with the property mutation you will be able to pay the tax. If you ever decide to sell your property, you will have to do the mutation.

Be assured that prospective buyers will ask for the mutation papers.

There are some special cases as well.

The process of mutation and documents required to complete the process of mutation is different in every state. However, there are certain circumstances under which the mutation of property is carried out in various places of the country.

Buying any property

If you have bought land in Mannivakkam, make sure it was listed under CMDA approved plots for sale in Mannivakkam. This will make the process of mutation easier as plots that have not been listed under CMDA can be sold by them in an auction. The documents which you need to submit would be a copy of the sale deed, a stamp paper containing an affidavit, court fee to submit the application of property mutation. Some more essential documents are an indemnity bond which needs to be on the stamp paper and the latest clearance of property tax being cleared.

In case of the death of the owner

On the passing of the owner of a property and you being the natural heir, mutation of the property is essential. Without the mutation, you cannot sell the property if you want to. The process of mutation, in this case, would require a copy of the will, death certificate of the owner, an indemnity bond (on a stamp paper), the last property tax being cleared, and an affidavit on an attested stamp paper by the notary.

When the property is bought by your power of attorney

For such a case, documents required are- a copy of papers stating the individual having the power of attorney, a stamp paper on which the indemnity bond is stated, an affidavit on the stamp paper, application for mutation on a stamp paper along with the court fee, and documents showing the clearance of the latest property tax.

All the mentioned cases require stamp papers of certain values.

Some more important points to note

When it comes to mutation of property, there are some more things that need to know such as-

- Some minimal penalty will be charged against you if you don’t get the mutation done.

- The mutation of your property can be done at any time, at your convenience.

- Although you are not legally bound to complete the mutation of your property, it will be better if you do. It stands as proof of you being the lawful owner. You will be able to pay taxes easily as well.

- Every state has its own rate charge when it comes to mutation of property.

- Mutation of property is not a one-time thing. You need to update the paperwork from time to time. Regularly updated records are equal to a clean record.

- In India, there are two kinds of mutation of properties, depending on the utility- agricultural, and non-agricultural. Agricultural land, as the name suggests, is used for any kind of farming and agricultural purpose. Non- agricultural land can be used for houses, residential plots, and apartments.

- If you do not get the mutation of your property done, it is highly likely that you may not be able to pay for the water and electricity.

We hope you can take notes from this article as you know all about mutation and its importance. With this information, you will be able to avoid any hassle regarding your property in the future.

Leave A Comment